Got my child's bank account in just 5 minutes!

Got my child's bank account in just 5 minutes!

Got my child's bank account in just 5 minutes!

100% online - no branch visits, no paperwork

Open a free bank account for your child from the comfort of your home.

Real-time insights

Monitor and guide your child’s financial activities with instant notifications and full visibility.

100% online - no branch visits, no paperwork

Open a free bank account for your child from the comfort of your home.

Real-time insights

Monitor and guide your child’s financial activities with instant notifications and full visibility.

100% online - no branch visits, no paperwork

Open a free bank account for your child from the comfort of your home.

Real-time insights

Monitor and guide your child’s financial activities with instant notifications and full visibility.

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

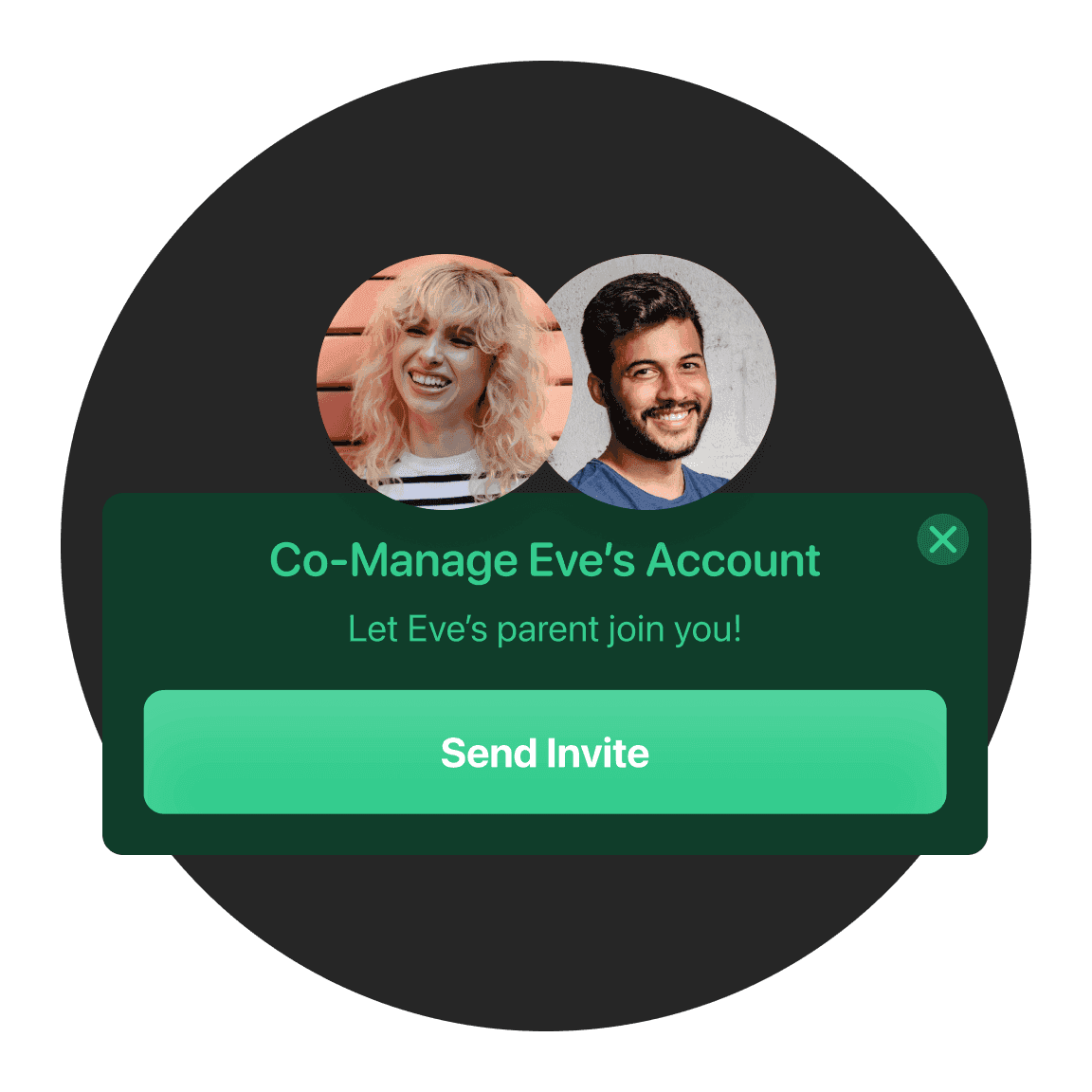

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Your child earns up to 2.67% interest on savings

Give your child a financial head start with a dedicated savings account that earns up to 2.67% interest. With weekly payouts, their savings grow faster—turning small contributions into big results over time.

Your child earns up to 2.67% interest on savings

Give your child a financial head start with a dedicated savings account that earns up to 2.67% interest. With weekly payouts, their savings grow faster—turning small contributions into big results over time.

Your child earns up to 2.67% interest on savings

Give your child a financial head start with a dedicated savings account that earns up to 2.67% interest. With weekly payouts, their savings grow faster—turning small contributions into big results over time.

Prepaid credit card

Your child gets their own bunq prepaid credit card, allowing them to spend responsibly with zero debt risk. You’ll be instantly notified whenever they make a payment.

Prepaid credit card

Your child gets their own bunq prepaid credit card, allowing them to spend responsibly with zero debt risk. You’ll be instantly notified whenever they make a payment.

Prepaid credit card

Your child gets their own bunq prepaid credit card, allowing them to spend responsibly with zero debt risk. You’ll be instantly notified whenever they make a payment.

Budgeting made easy

Create up to 25 money pots for your child to spend, save, and grow their money in a fun way. Plus, track their budget with detailed insights, monthly comparisons, and categorized breakdowns.

Budgeting made easy

Create up to 25 money pots for your child to spend, save, and grow their money in a fun way. Plus, track their budget with detailed insights, monthly comparisons, and categorized breakdowns.

Budgeting made easy

Create up to 25 money pots for your child to spend, save, and grow their money in a fun way. Plus, track their budget with detailed insights, monthly comparisons, and categorized breakdowns.

Round up payments and save the difference

With AutoSave, your child's payments are rounded up, and the difference is sent directly to their savings account. For example, if they spend €4.10, €0.90 goes straight to their savings—that simple.

Round up payments and save the difference

With AutoSave, your child's payments are rounded up, and the difference is sent directly to their savings account. For example, if they spend €4.10, €0.90 goes straight to their savings—that simple.

Round up payments and save the difference

With AutoSave, your child's payments are rounded up, and the difference is sent directly to their savings account. For example, if they spend €4.10, €0.90 goes straight to their savings—that simple.

Automatically sort their pocket money

With Salary Sorter, your child’s incoming allowance is instantly sorted into their savings account or spending pot.

Automatically sort their pocket money

With Salary Sorter, your child’s incoming allowance is instantly sorted into their savings account or spending pot.

Automatically sort their pocket money

With Salary Sorter, your child’s incoming allowance is instantly sorted into their savings account or spending pot.

Personal payment link

Your child can set up their personal payment link so that family and friends can easily send them money straight to their account.

Personal payment link

Your child can set up their personal payment link so that family and friends can easily send them money straight to their account.

Personal payment link

Your child can set up their personal payment link so that family and friends can easily send them money straight to their account.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Find your perfect fit

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Find your perfect fit

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Find your perfect fit

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.