bunq Core

The bank account for everyday use.

bunq Core

The bank account for everyday use.

bunq Core

The bank account for everyday use.

Your new bank account, ready in just 5 minutes

100% online - no branch visits, no paperwork

Just download the bunq app and sign up from anywhere.

Start without a tax ID

No tax ID? No problem. Start banking right away and provide it within 90 days.

Earn up to 2.67% interest - paid out weekly

Boost your savings with 2.67% interest on EUR, and 3.01% on USD and GBP

Your new bank account, ready in just 5 minutes

100% online - no branch visits, no paperwork

Just download the bunq app and sign up from anywhere.

Start without a tax ID

No tax ID? No problem. Start banking right away and provide it within 90 days.

Earn up to 2.67% interest - paid out weekly

Boost your savings with 2.67% interest on EUR, and 3.01% on USD and GBP

Your new bank account, ready in just 5 minutes

100% online - no branch visits, no paperwork

Just download the bunq app and sign up from anywhere.

Start without a tax ID

No tax ID? No problem. Start banking right away and provide it within 90 days.

Earn up to 2.67% interest - paid out weekly

Boost your savings with 2.67% interest on EUR, and 3.01% on USD and GBP

Bank account & Savings account

Take your budgeting to the next level by organizing your finances with up to 5 dedicated money pots. Each with a unique IBAN, so you can easily transfer money and even use them for direct debits.

Bank account & Savings account

Take your budgeting to the next level by organizing your finances with up to 5 dedicated money pots. Each with a unique IBAN, so you can easily transfer money and even use them for direct debits.

Bank account & Savings account

Take your budgeting to the next level by organizing your finances with up to 5 dedicated money pots. Each with a unique IBAN, so you can easily transfer money and even use them for direct debits.

2.67%* interest paid out weekly

Make your savings grow faster with a highly competitive interest rate. Earnings get paid out weekly, so you benefit from compound interest and reach your goals even quicker.

2.67%* interest paid out weekly

Make your savings grow faster with a highly competitive interest rate. Earnings get paid out weekly, so you benefit from compound interest and reach your goals even quicker.

2.67%* interest paid out weekly

Make your savings grow faster with a highly competitive interest rate. Earnings get paid out weekly, so you benefit from compound interest and reach your goals even quicker.

Get your Cards

With bunq Core, get 1 Virtual Debit or Credit Card and 1 physical card. Get it, top it up and instantly start making payments online or with your phone.

Get your Cards

With bunq Core, get 1 Virtual Debit or Credit Card and 1 physical card. Get it, top it up and instantly start making payments online or with your phone.

Get your Cards

With bunq Core, get 1 Virtual Debit or Credit Card and 1 physical card. Get it, top it up and instantly start making payments online or with your phone.

Effortless payment management

Simplify outgoing payments with AutoAccept and Scheduled Payments. Automatically approve requests from trusted contacts and allow them to schedule payments in advance.

Effortless payment management

Simplify outgoing payments with AutoAccept and Scheduled Payments. Automatically approve requests from trusted contacts and allow them to schedule payments in advance.

Effortless payment management

Simplify outgoing payments with AutoAccept and Scheduled Payments. Automatically approve requests from trusted contacts and allow them to schedule payments in advance.

Get the best exchange rate abroad

Spend smarter with ZeroFX. Use your bunq bank debit or credit card to get great value on purchases in currencies outside the Eurozone.

Get the best exchange rate abroad

Spend smarter with ZeroFX. Use your bunq bank debit or credit card to get great value on purchases in currencies outside the Eurozone.

Get the best exchange rate abroad

Spend smarter with ZeroFX. Use your bunq bank debit or credit card to get great value on purchases in currencies outside the Eurozone.

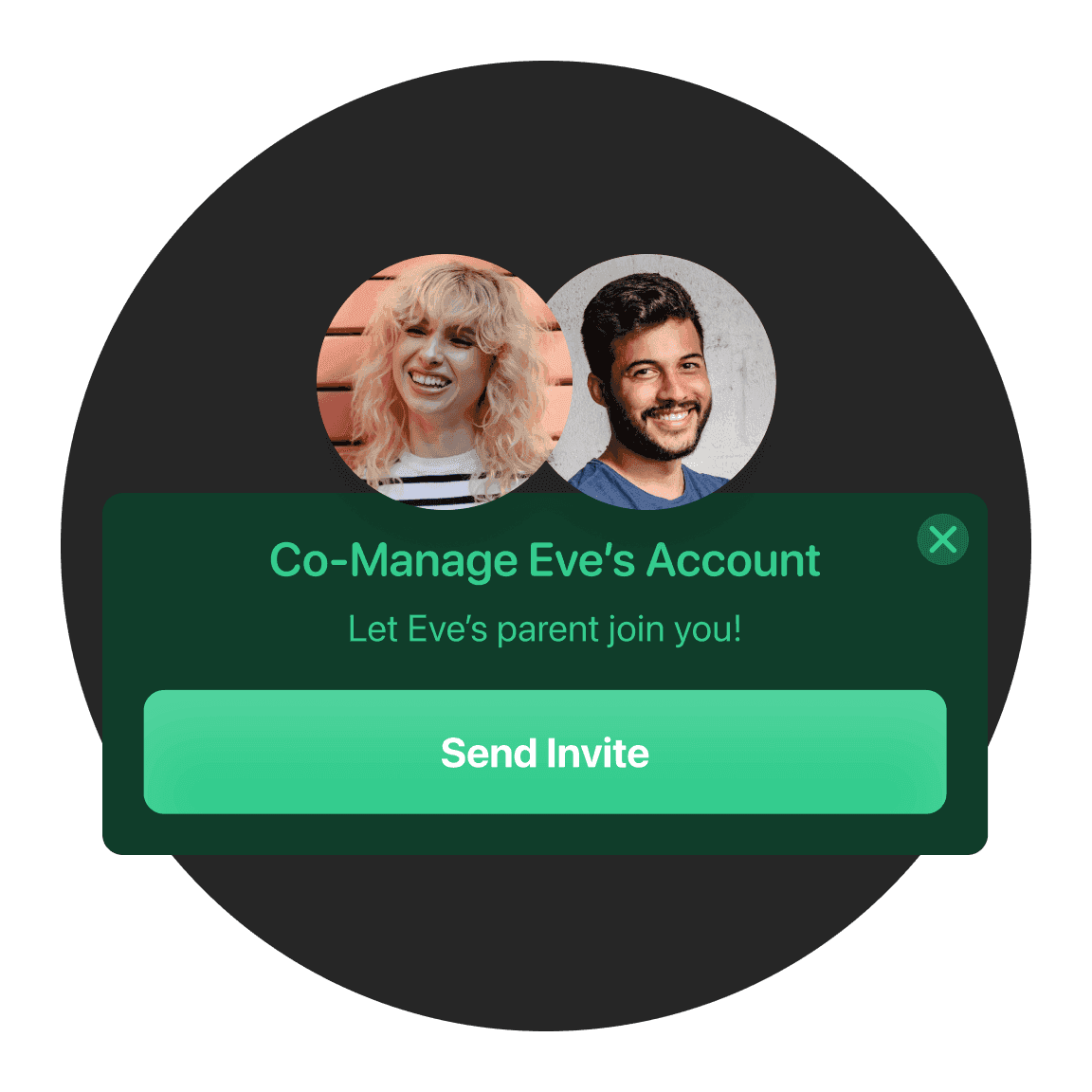

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

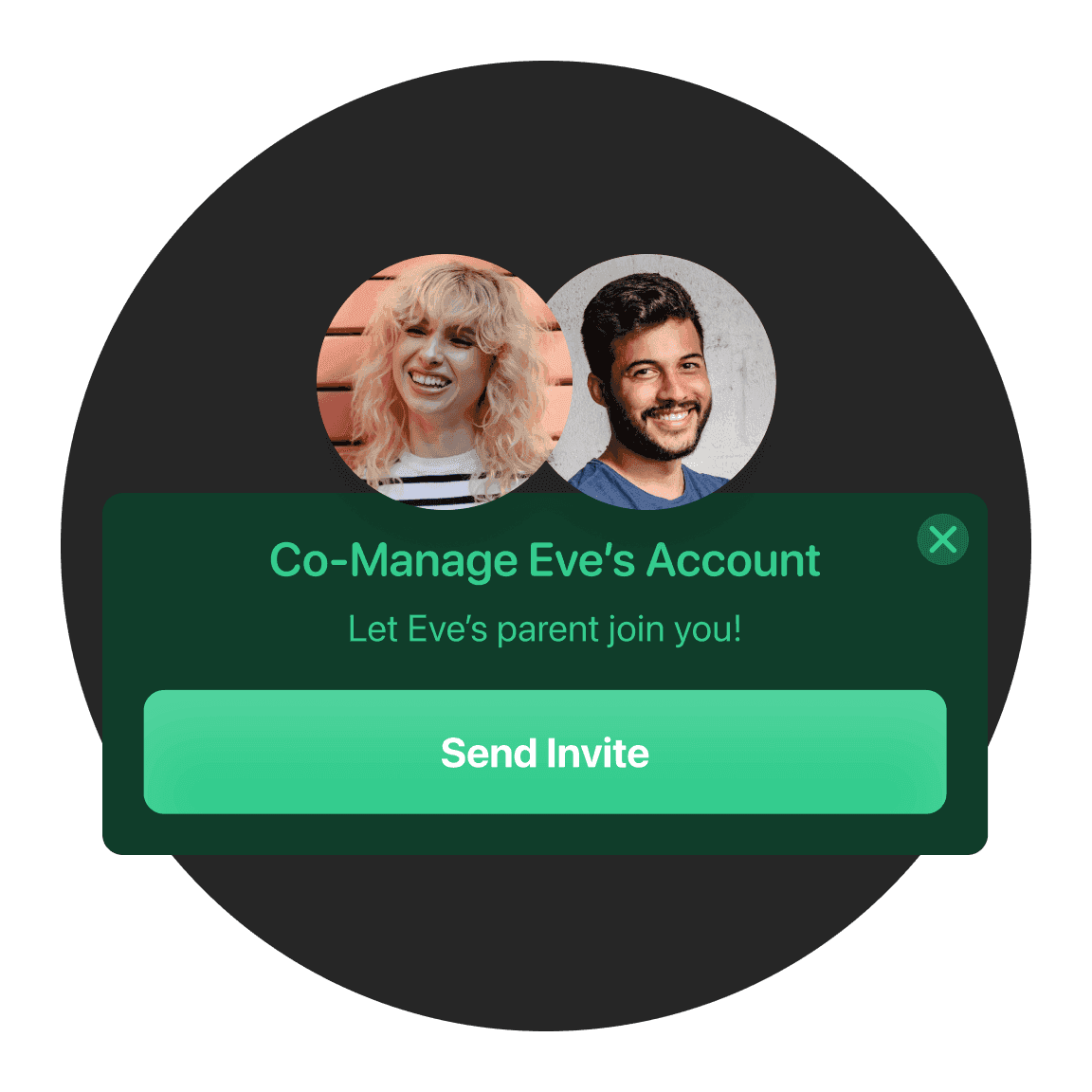

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

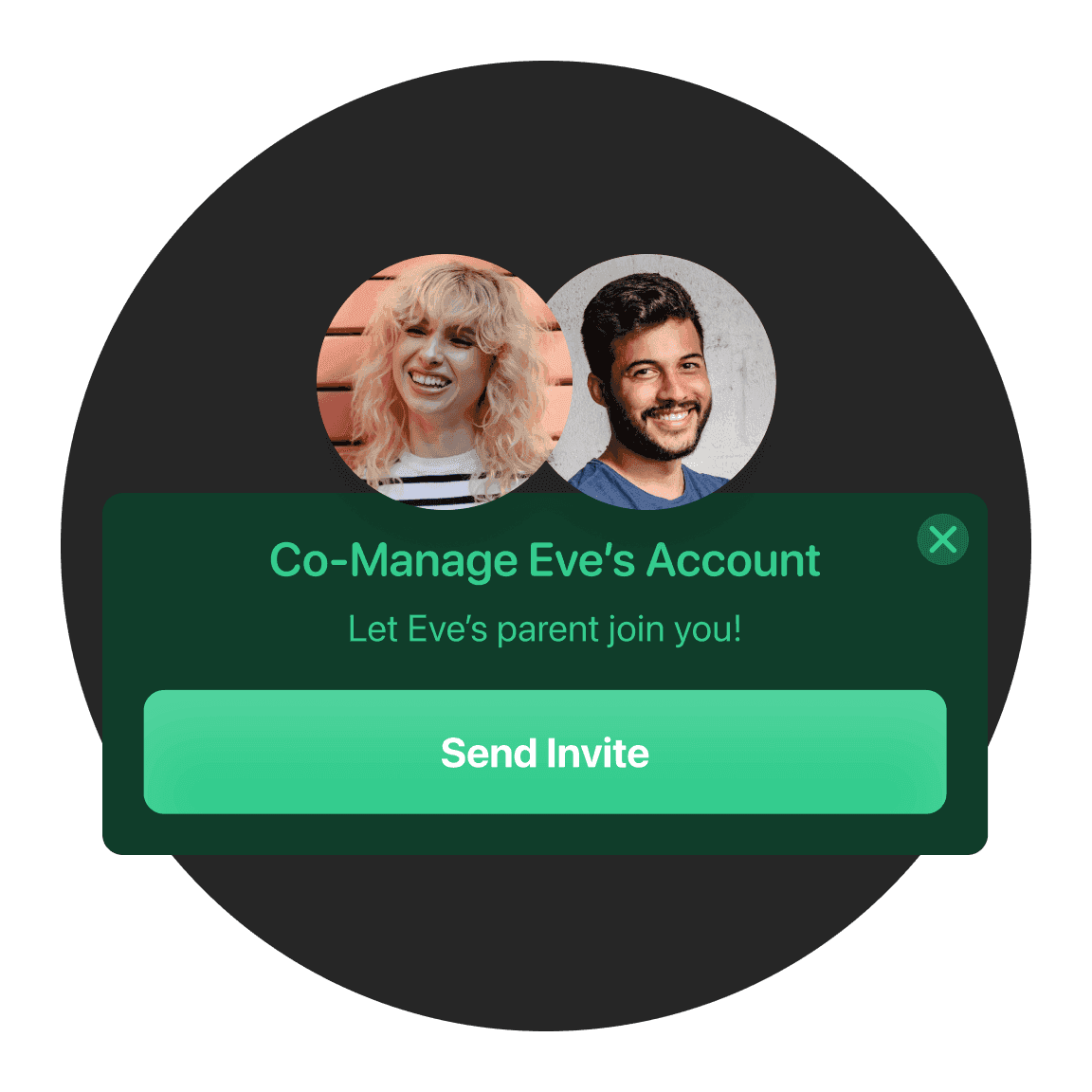

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Earn bunq Points

Earn exclusive rewards just by using your bunq card: free months of bunq, metal card, travel discounts, and more!

Earn bunq Points

Earn exclusive rewards just by using your bunq card: free months of bunq, metal card, travel discounts, and more!

Earn bunq Points

Earn exclusive rewards just by using your bunq card: free months of bunq, metal card, travel discounts, and more!

24/7 Online Support and SOS Hotline

Contact us 24/7/365 through the secure in-app chat, email, or SOS phone line for urgent card blocking or account access issues. We’ll provide personalized priority assistance to help you make the most of your bunq account—all in your language!

24/7 Online Support and SOS Hotline

Contact us 24/7/365 through the secure in-app chat, email, or SOS phone line for urgent card blocking or account access issues. We’ll provide personalized priority assistance to help you make the most of your bunq account—all in your language!

24/7 Online Support and SOS Hotline

Contact us 24/7/365 through the secure in-app chat, email, or SOS phone line for urgent card blocking or account access issues. We’ll provide personalized priority assistance to help you make the most of your bunq account—all in your language!

Offset your CO2

As a bunq user, you'll earn trees for spending with your bunq card. Our partner veritree then plants these in Kenya and Tanzania. Our users have already planted over 25 million mangrove trees! Plant 1 tree for every €1000 you spend.

Offset your CO2

As a bunq user, you'll earn trees for spending with your bunq card. Our partner veritree then plants these in Kenya and Tanzania. Our users have already planted over 25 million mangrove trees! Plant 1 tree for every €1000 you spend.

Offset your CO2

As a bunq user, you'll earn trees for spending with your bunq card. Our partner veritree then plants these in Kenya and Tanzania. Our users have already planted over 25 million mangrove trees! Plant 1 tree for every €1000 you spend.

Trusted by millions of users

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Help in your language, whenever you need it.

Trusted by millions of users

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Help in your language, whenever you need it.

Trusted by millions of users

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Help in your language, whenever you need it.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Compare our plans

bunq Free

Free

The standard bank account

bunq Core

€3.99/month

The bank account for everyday

bunq Pro

€9.99/month

The bank account that makes budgeting easy

bunq Elite

€18.99/month

The bank account designed for your international lifestyle

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Compare our plans

bunq Free

Free

The standard bank account

bunq Core

€3.99/month

The bank account for everyday

bunq Pro

€9.99/month

The bank account that makes budgeting easy

bunq Elite

€18.99/month

The bank account designed for your international lifestyle

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Compare our plans

bunq Free

Free

The standard bank account

bunq Core

€3.99/month

The bank account for everyday

bunq Pro

€9.99/month

The bank account that makes budgeting easy

bunq Elite

€18.99/month

The bank account designed for your international lifestyle

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.