bunq Elite

The bank account designed for your international lifestyle.

Your new bank account, ready in just 5 minutes

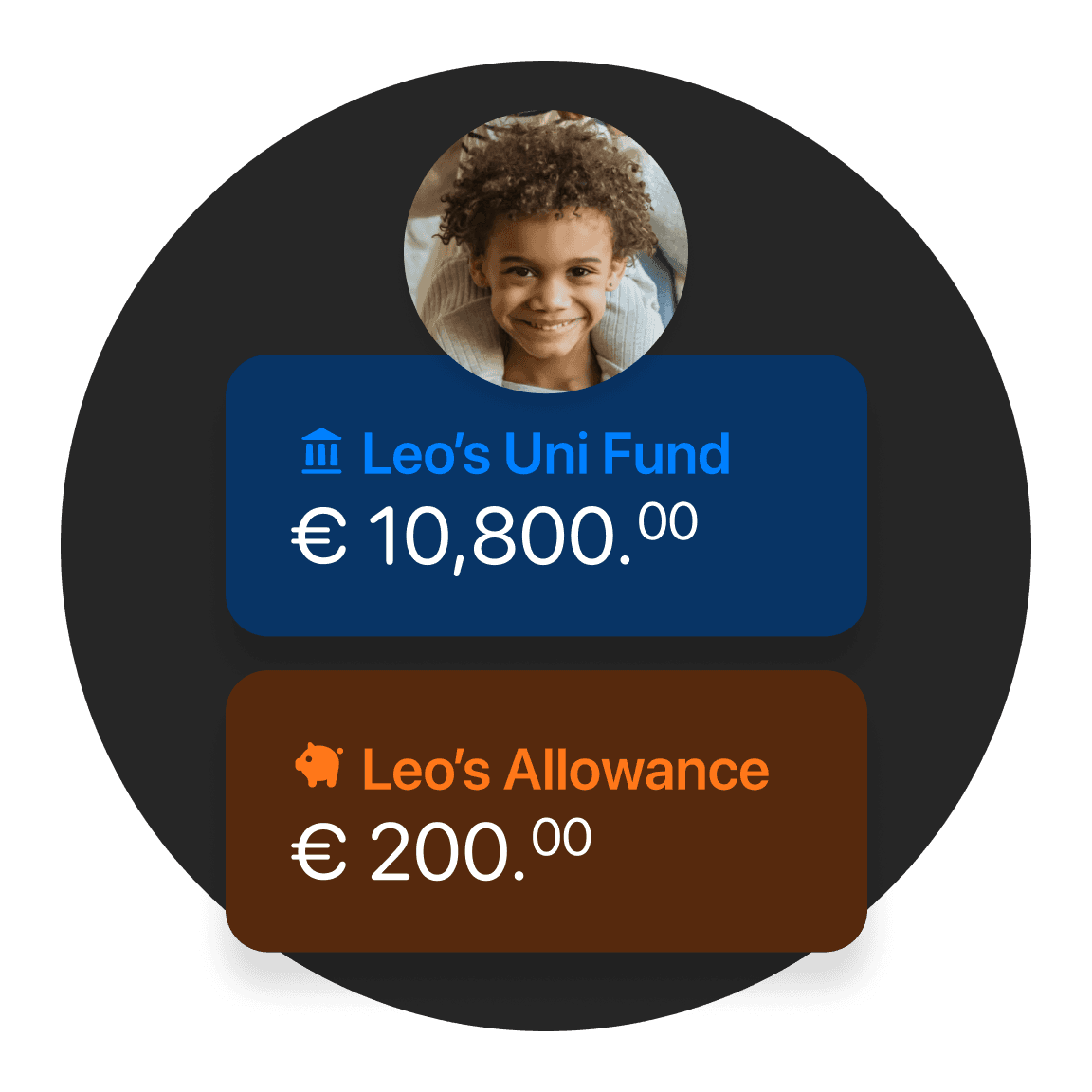

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

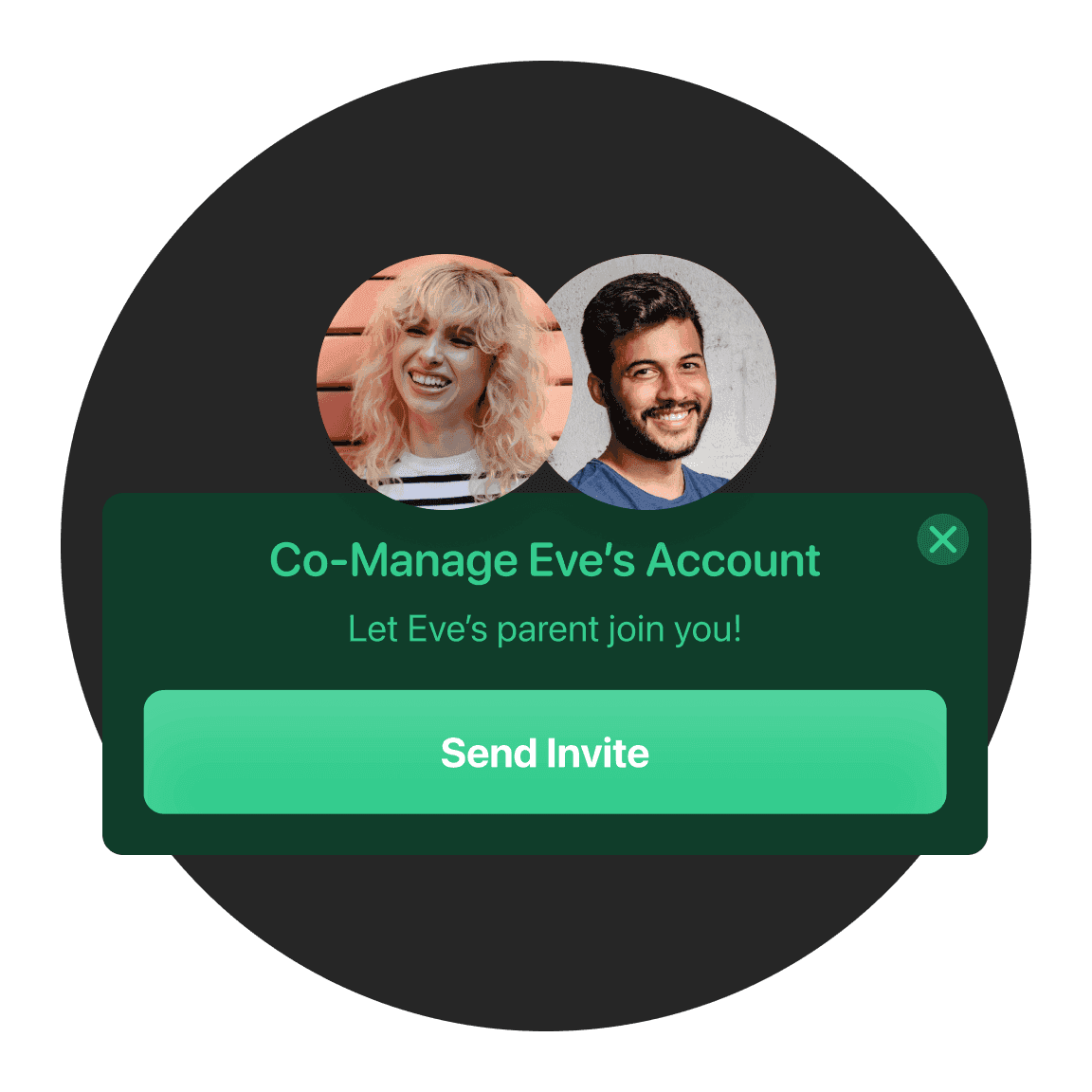

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Bank account & Savings account

Take your budgeting to the next level by organizing your finances with up to 25 dedicated money pots. Each with a unique IBAN, so you can easily transfer money and even use them for direct debits.

Get your Cards

The bunq Elite plan includes 25 Virtual Debit or Credit Card and 3 physical cards. Get it, top it up, and instantly start making payments online or with your phone.

2,51%* interest paid out weekly

Make your savings grow faster with a highly competitive interest rate. Earnings get paid out weekly, so you benefit from compound interest and reach your goals even quicker.

Worldwide Travel Insurance with zero hassle

No more triple-checking your travel insurance for trips abroad. Wherever you go, you’re automatically covered, including rental car insurance. Travel Insurance is included in your plan at no extra cost.

Earn up to 2% Cashback

Wherever you go, just use your bunq Credit Card, and we'll put 1% of everything you pay at a restaurant or bar, and 2% for all public transportation costs, back into your pocket.

Earn 2x bunq Points

Earn exclusive rewards just by using your bunq card: free months of bunq, a metal card, travel discounts, and more! bunq Elite users earn double points.

Grow your wealth

Invest on the go with the bunq app. Start with just €10 and enjoy zero fees for the first 3 months. 50% discount on fees after 3 months.

Offset your CO2

With their bunq card, your child can earn trees for every purchase. Through our partner veritree, these trees are planted in Kenya and Tanzania. Together, bunq users have already planted over 25 million mangrove trees!

Trusted by millions of users

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Choose your own plan

You and your child can enjoy the benefits of a bunq account when you subscribe to a paid bunq plan.

bunq Core

€3,99/month

The bank account for your child’s first steps in daily spendings and savings

bunq Pro

€9,99/month

The bank account for your child to manage their finances.

bunq Elite

€18,99/month

The bank account that grows with your child.

Open your bank account in just 5 minutes

All you need to get started is your phone and ID.