Tap to Pay on iPhone

Accept card payments for your business with just your iPhone.

Tap to Pay on iPhone

Accept card payments for your business with just your iPhone.

Tap to Pay on iPhone

Accept card payments for your business with just your iPhone.

Use iPhone to accept contactless payments

With Tap to Pay on iPhone and bunq, you can accept all types of in-person, contactless payments right on your iPhone—from physical debit and credit cards to Apple Pay and other digital wallets—no extra terminals or hardware needed. It’s easy, secure, and private.

Use iPhone to accept contactless payments

With Tap to Pay on iPhone and bunq, you can accept all types of in-person, contactless payments right on your iPhone—from physical debit and credit cards to Apple Pay and other digital wallets—no extra terminals or hardware needed. It’s easy, secure, and private.

Use iPhone to accept contactless payments

With Tap to Pay on iPhone and bunq, you can accept all types of in-person, contactless payments right on your iPhone—from physical debit and credit cards to Apple Pay and other digital wallets—no extra terminals or hardware needed. It’s easy, secure, and private.

Here's how it works

Open the bunq app on your iPhone.

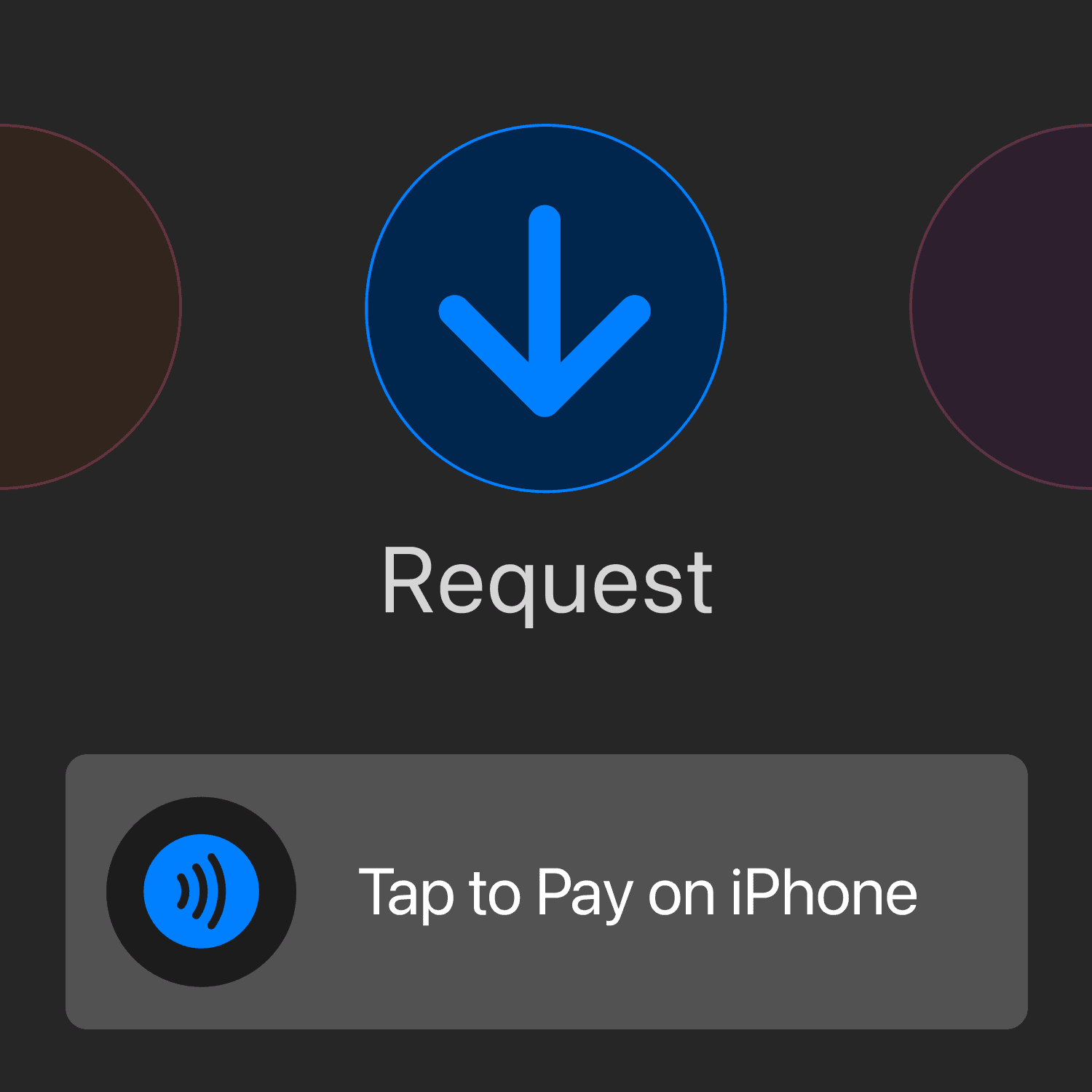

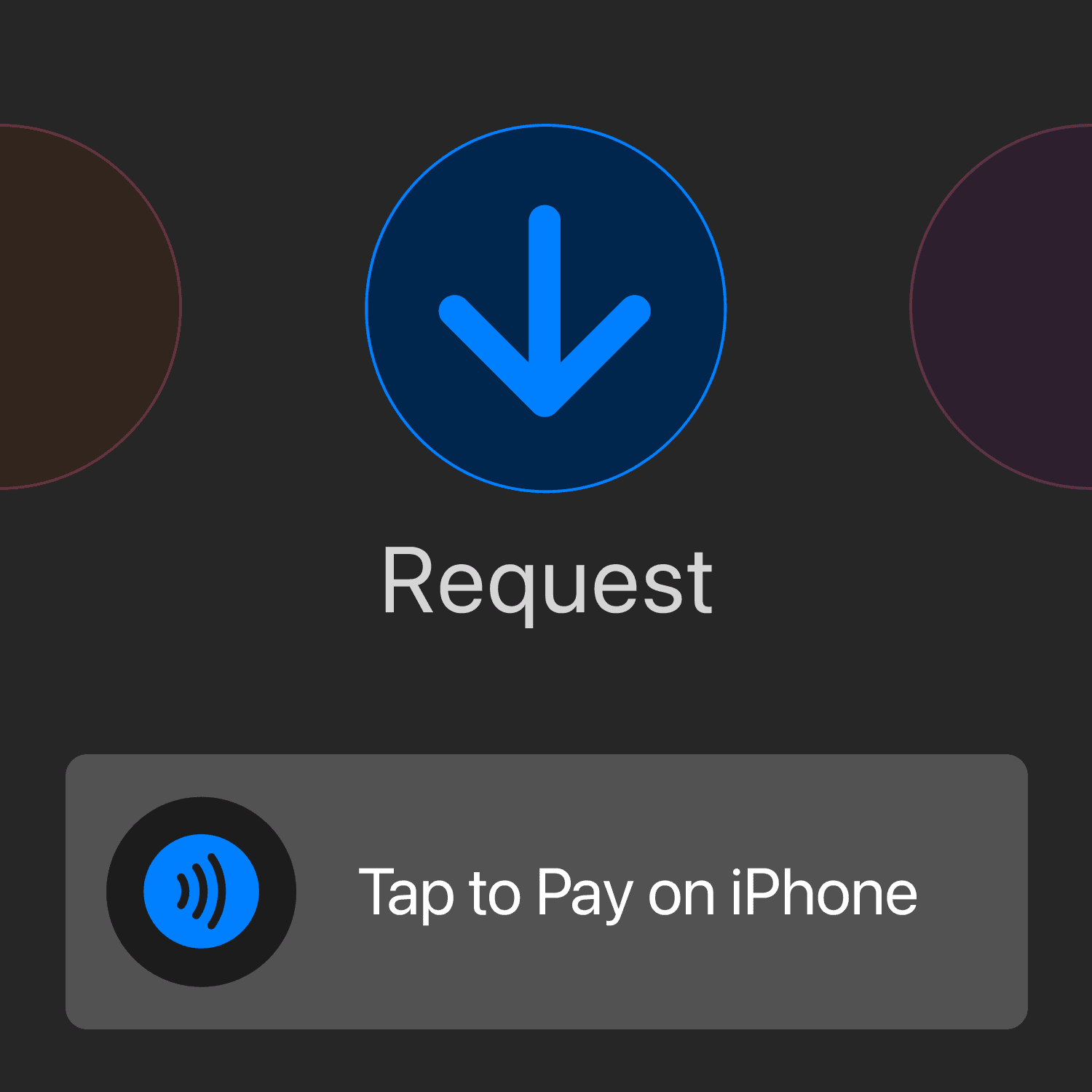

Tap Request, set an amount and choose Tap to Pay on iPhone as the method.

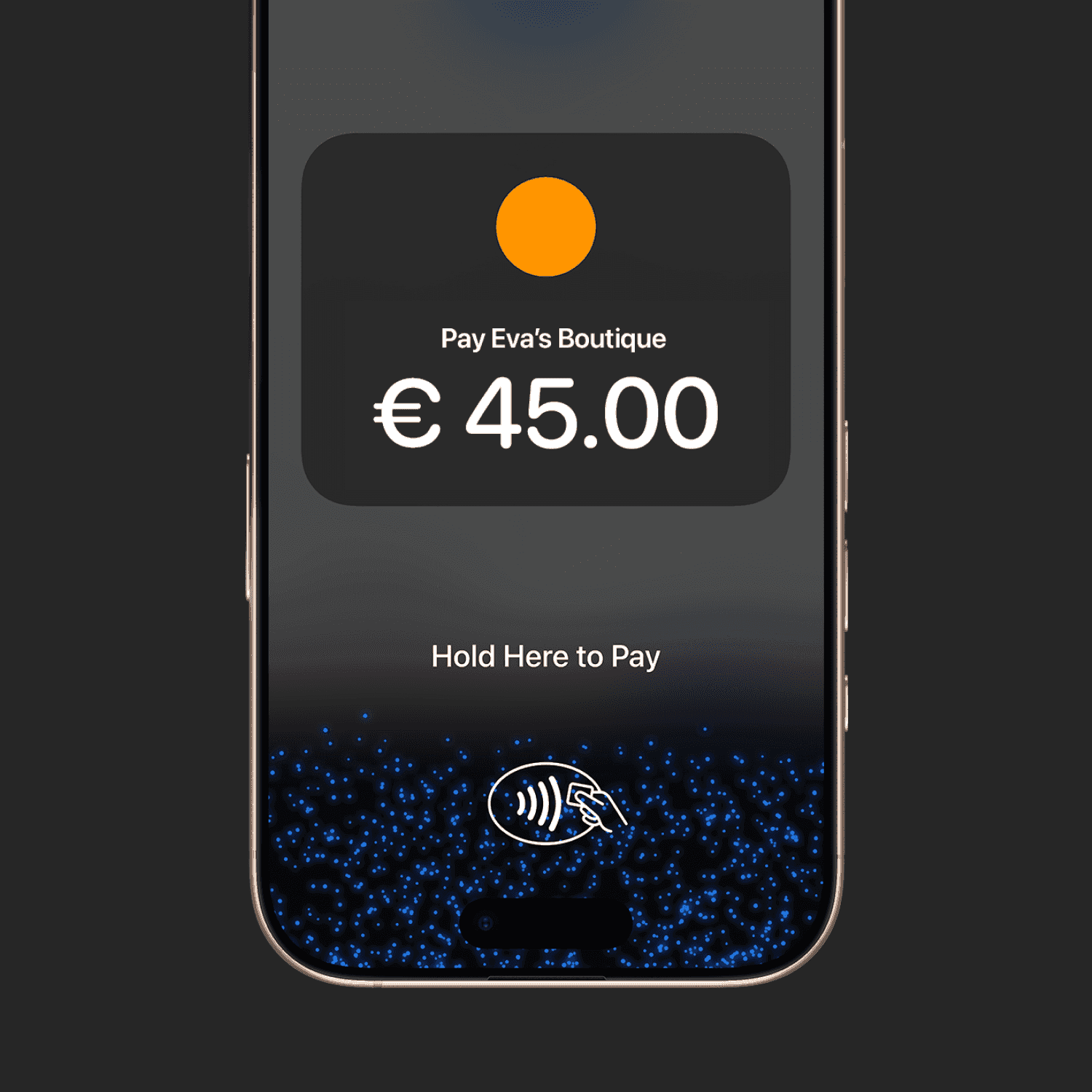

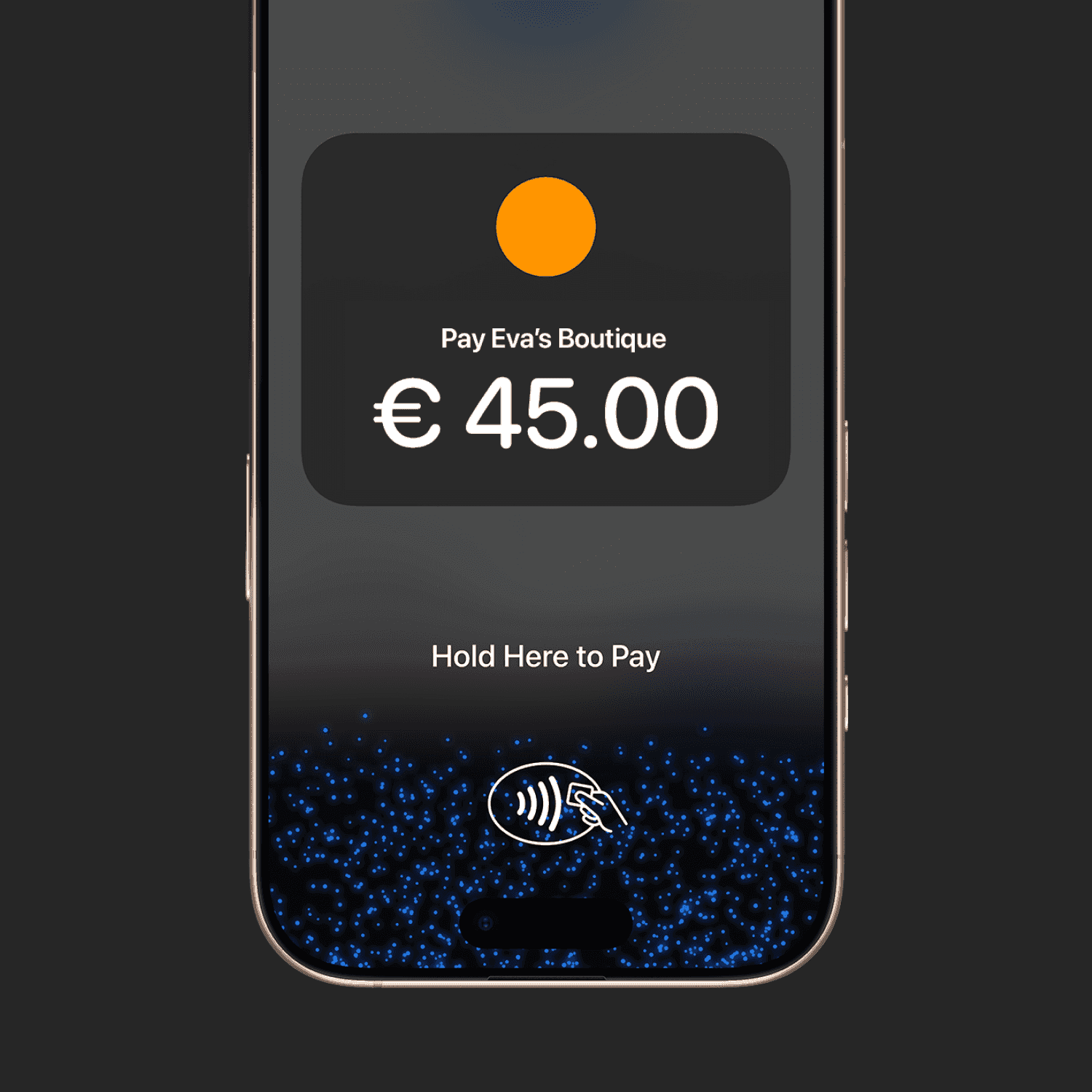

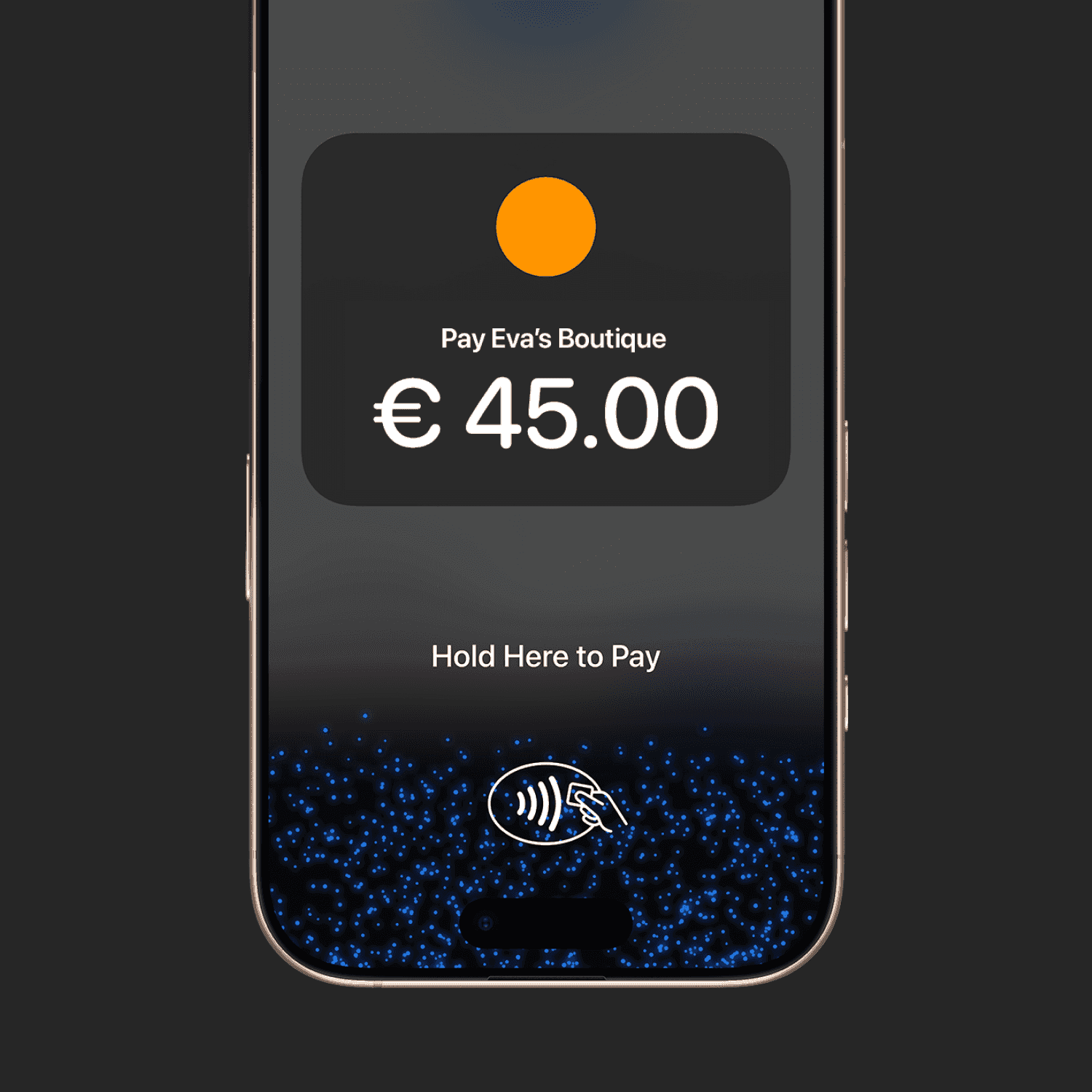

Present your iPhone to your customer.

Your customer holds their card horizontally at the top of your iPhone, over the contactless symbol.

When you see the Done checkmark, the card read is complete and the transaction is being processed.

Here's how it works

Open the bunq app on your iPhone.

Tap Request, set an amount and choose Tap to Pay on iPhone as the method.

Present your iPhone to your customer.

Your customer holds their card horizontally at the top of your iPhone, over the contactless symbol.

When you see the Done checkmark, the card read is complete and the transaction is being processed.

Here's how it works

Open the bunq app on your iPhone.

Tap Request, set an amount and choose Tap to Pay on iPhone as the method.

Present your iPhone to your customer.

Your customer holds their card horizontally at the top of your iPhone, over the contactless symbol.

When you see the Done checkmark, the card read is complete and the transaction is being processed.

bunq's Transparent Pricing

With bunq, you are charged 1.5% per transaction—no matter which card your customer uses. No surprises, no hidden fees. Just tap and go, every time.

€0.00

Activation costs

€0.00

Monthly fees

1.50%

per transaction

bunq's Transparent Pricing

With bunq, you are charged 1.5% per transaction—no matter which card your customer uses. No surprises, no hidden fees. Just tap and go, every time.

€0.00

Activation costs

€0.00

Monthly fees

1.50%

per transaction

bunq's Transparent Pricing

With bunq, you are charged 1.5% per transaction—no matter which card your customer uses. No surprises, no hidden fees. Just tap and go, every time.

€0.00

Activation costs

€0.00

Monthly fees

1.50%

per transaction

Tap to Pay on iPhone requires a supported payment app and the latest version of iOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install. Some contactless cards may not be accepted by your payment app. Transaction limits may apply. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Tap to Pay on iPhone is not available in all markets. For Tap to Pay on iPhone countries and regions, see https://developer.apple.com/tap-to-pay/regions/

Tap to Pay on iPhone requires a supported payment app and the latest version of iOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install. Some contactless cards may not be accepted by your payment app. Transaction limits may apply. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Tap to Pay on iPhone is not available in all markets. For Tap to Pay on iPhone countries and regions, see https://developer.apple.com/tap-to-pay/regions/

Tap to Pay on iPhone requires a supported payment app and the latest version of iOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install. Some contactless cards may not be accepted by your payment app. Transaction limits may apply. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Tap to Pay on iPhone is not available in all markets. For Tap to Pay on iPhone countries and regions, see https://developer.apple.com/tap-to-pay/regions/

Trusted by millions of users

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Help in your language, whenever you need it.

Trusted by millions of users

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Help in your language, whenever you need it.

Trusted by millions of users

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Help in your language, whenever you need it.

Available on these plans

bunq Free Business

Free for Sole Proprietors

The business bank account that gets you started.

bunq Core Business

€7.99/month

Everything you need to run your business.

bunq Pro Business

€13.99/month

Everything you need to scale your business.

bunq Elite Business

€23.99/month

Next level banking for your international business.

Available on these plans

bunq Free Business

Free for Sole Proprietors

The business bank account that gets you started.

bunq Core Business

€7.99/month

Everything you need to run your business.

bunq Pro Business

€13.99/month

Everything you need to scale your business.

bunq Elite Business

€23.99/month

Next level banking for your international business.

Available on these plans

bunq Free Business

Free for Sole Proprietors

The business bank account that gets you started.

bunq Core Business

€7.99/month

Everything you need to run your business.

bunq Pro Business

€13.99/month

Everything you need to scale your business.

bunq Elite Business

€23.99/month

Next level banking for your international business.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.