AutoSave

Round up payments and save the difference.

AutoSave

Round up payments and save the difference.

AutoSave

Round up payments and save the difference.

What's AutoSave?

Reach your savings goals faster by turning on AutoSave. Every payment you make gets rounded up, and the difference is sent to one of your Savings Accounts. For example, the next time you spend €2.20 on that iced latte, you’ll add €0.80 to your savings automatically. You can also choose to save faster by rounding up to the next 2 or 5 euros.

What's AutoSave?

Reach your savings goals faster by turning on AutoSave. Every payment you make gets rounded up, and the difference is sent to one of your Savings Accounts. For example, the next time you spend €2.20 on that iced latte, you’ll add €0.80 to your savings automatically. You can also choose to save faster by rounding up to the next 2 or 5 euros.

What's AutoSave?

Reach your savings goals faster by turning on AutoSave. Every payment you make gets rounded up, and the difference is sent to one of your Savings Accounts. For example, the next time you spend €2.20 on that iced latte, you’ll add €0.80 to your savings automatically. You can also choose to save faster by rounding up to the next 2 or 5 euros.

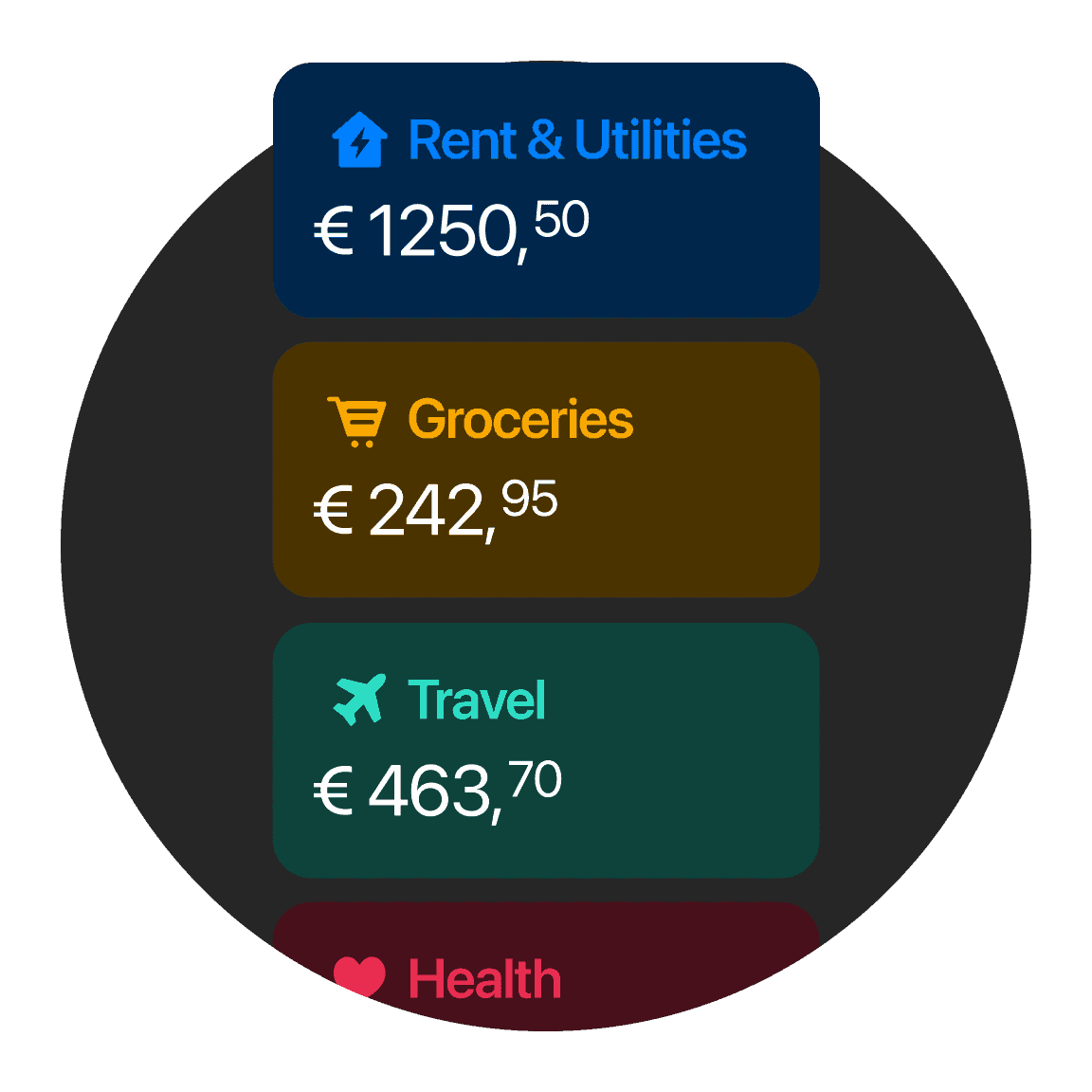

Take it to the next level with Easy Budgeting

Want to take your budgeting to the next level? Create up to 25 Bank Accounts and budget from them automatically!

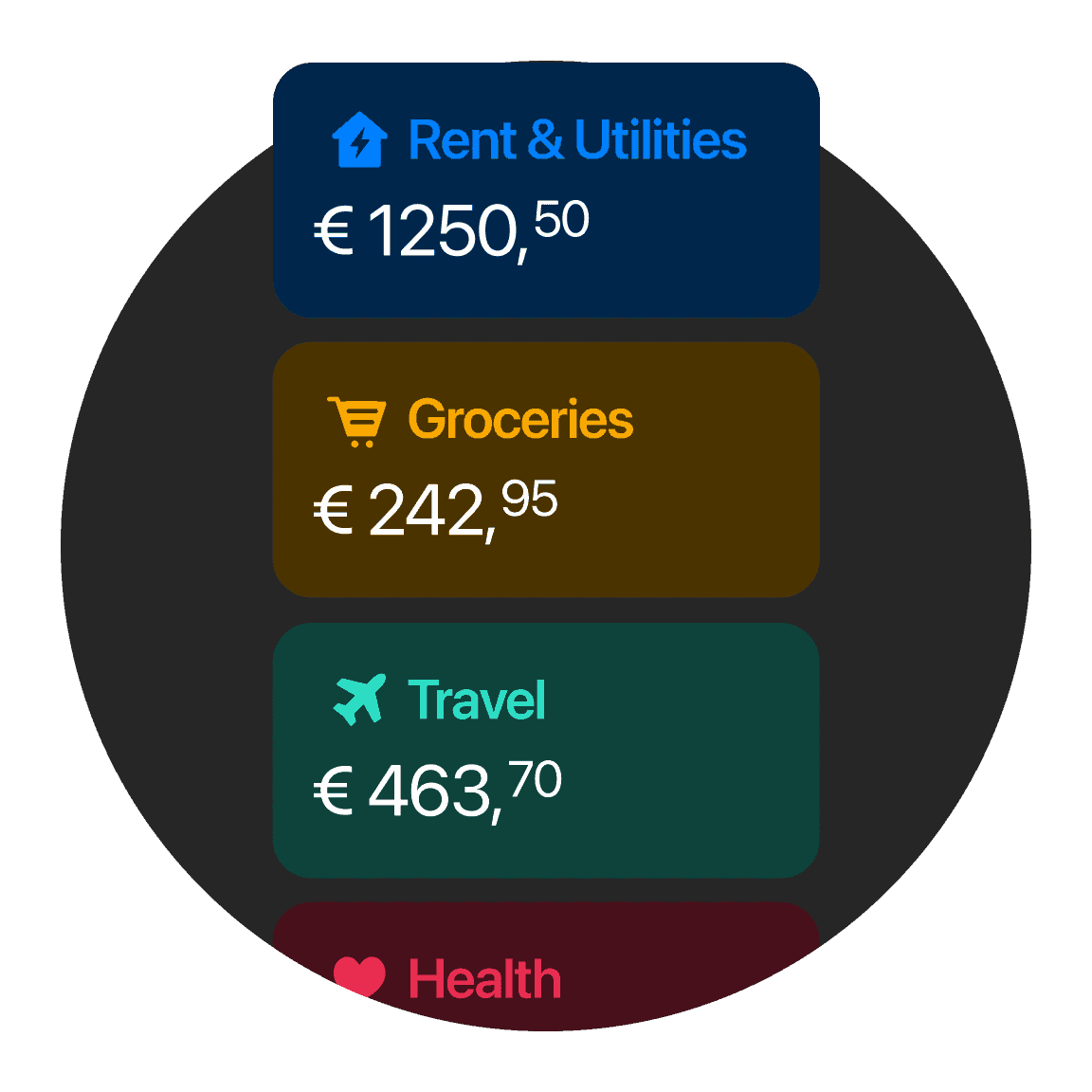

Take it to the next level with Easy Budgeting

Want to take your budgeting to the next level? Create up to 25 Bank Accounts and budget from them automatically!

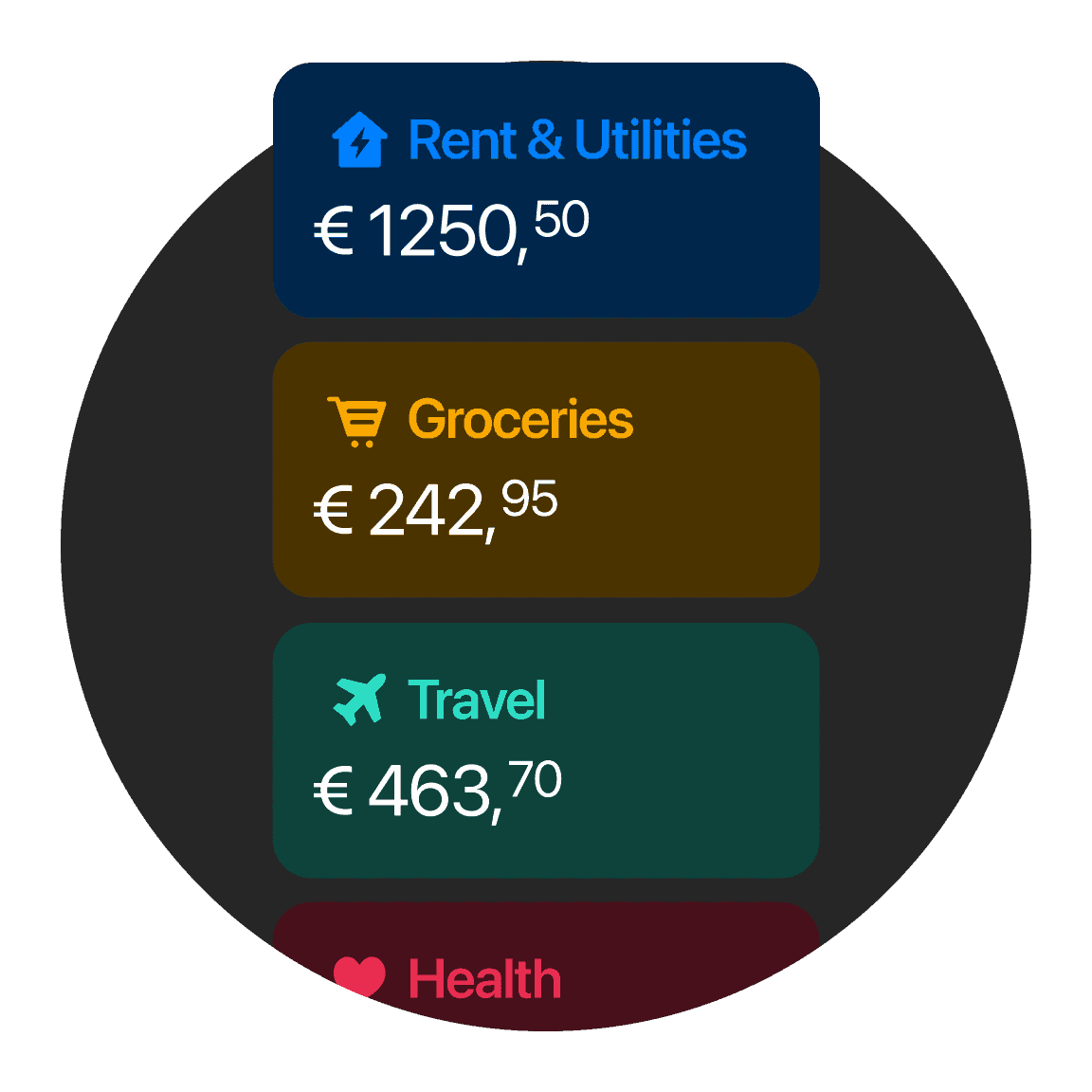

Take it to the next level with Easy Budgeting

Want to take your budgeting to the next level? Create up to 25 Bank Accounts and budget from them automatically!

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Available on these plans

bunq Pro

€9.99/month

The bank account that travels with you.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Available on these plans

bunq Pro

€9.99/month

The bank account that travels with you.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Available on these plans

bunq Pro

€9.99/month

The bank account that travels with you.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.