Helping your child grow financially?

Open your child’s free bank account in just 5 minutes with only your phone. Try bunq today, no strings attached.

Helping your child grow financially?

Open your child’s free bank account in just 5 minutes with only your phone. Try bunq today, no strings attached.

Helping your child grow financially?

Open your child’s free bank account in just 5 minutes with only your phone. Try bunq today, no strings attached.

Your child's free bank account, ready in just 5 minutes.

100% online - no branch visits, no paperwork

Open a free bank account for your child from the comfort of your home.

Earn up to 2.67% interest on savings

Start growing your child’s savings with weekly interest payouts.

Real-time insights

Monitor and guide your child’s financial activities with instant notifications and full visibility.

Your child's free bank account, ready in just 5 minutes.

100% online - no branch visits, no paperwork

Open a free bank account for your child from the comfort of your home.

Earn up to 2.67% interest on savings

Start growing your child’s savings with weekly interest payouts.

Real-time insights

Monitor and guide your child’s financial activities with instant notifications and full visibility.

Your child's free bank account, ready in just 5 minutes.

100% online - no branch visits, no paperwork

Open a free bank account for your child from the comfort of your home.

Earn up to 2.67% interest on savings

Start growing your child’s savings with weekly interest payouts.

Real-time insights

Monitor and guide your child’s financial activities with instant notifications and full visibility.

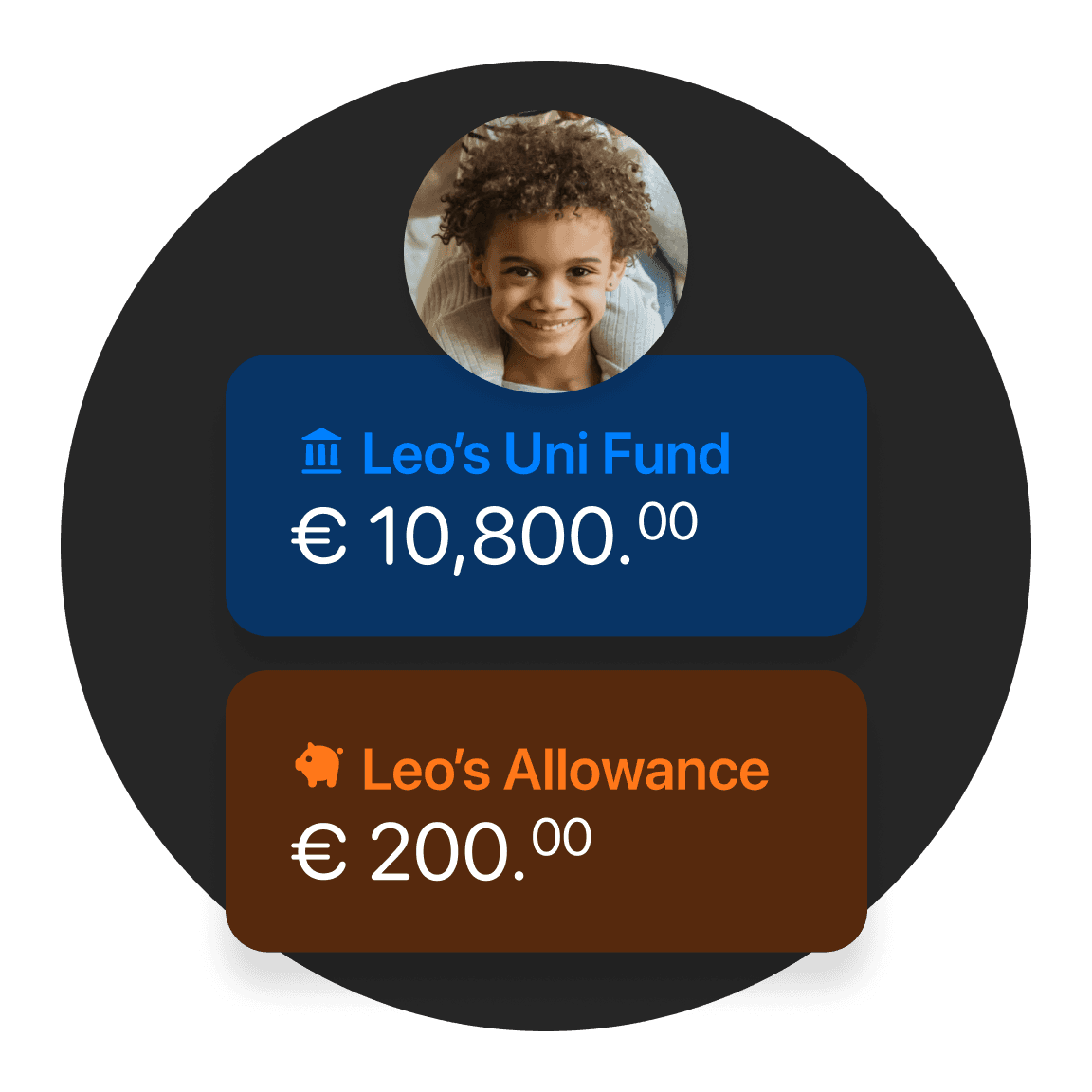

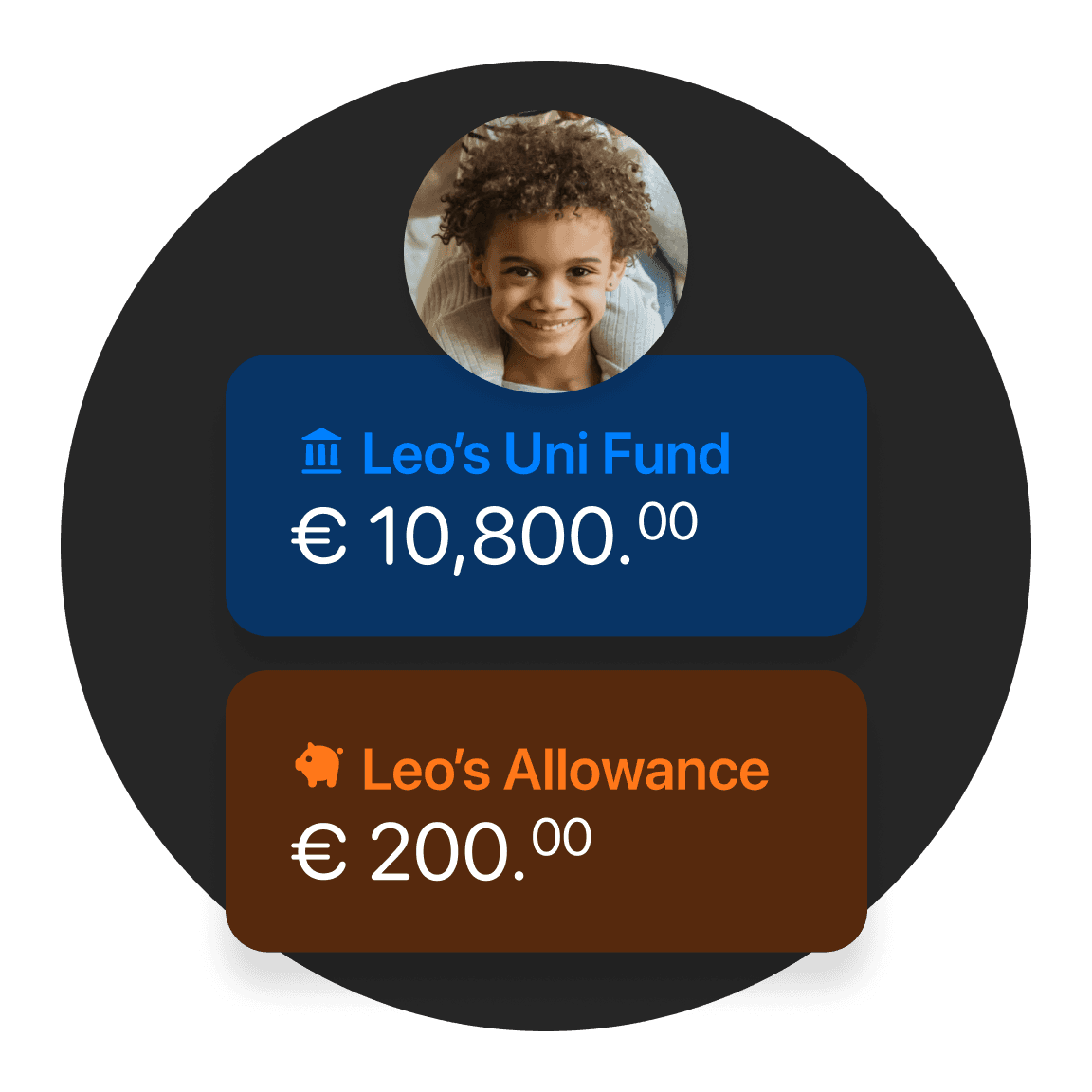

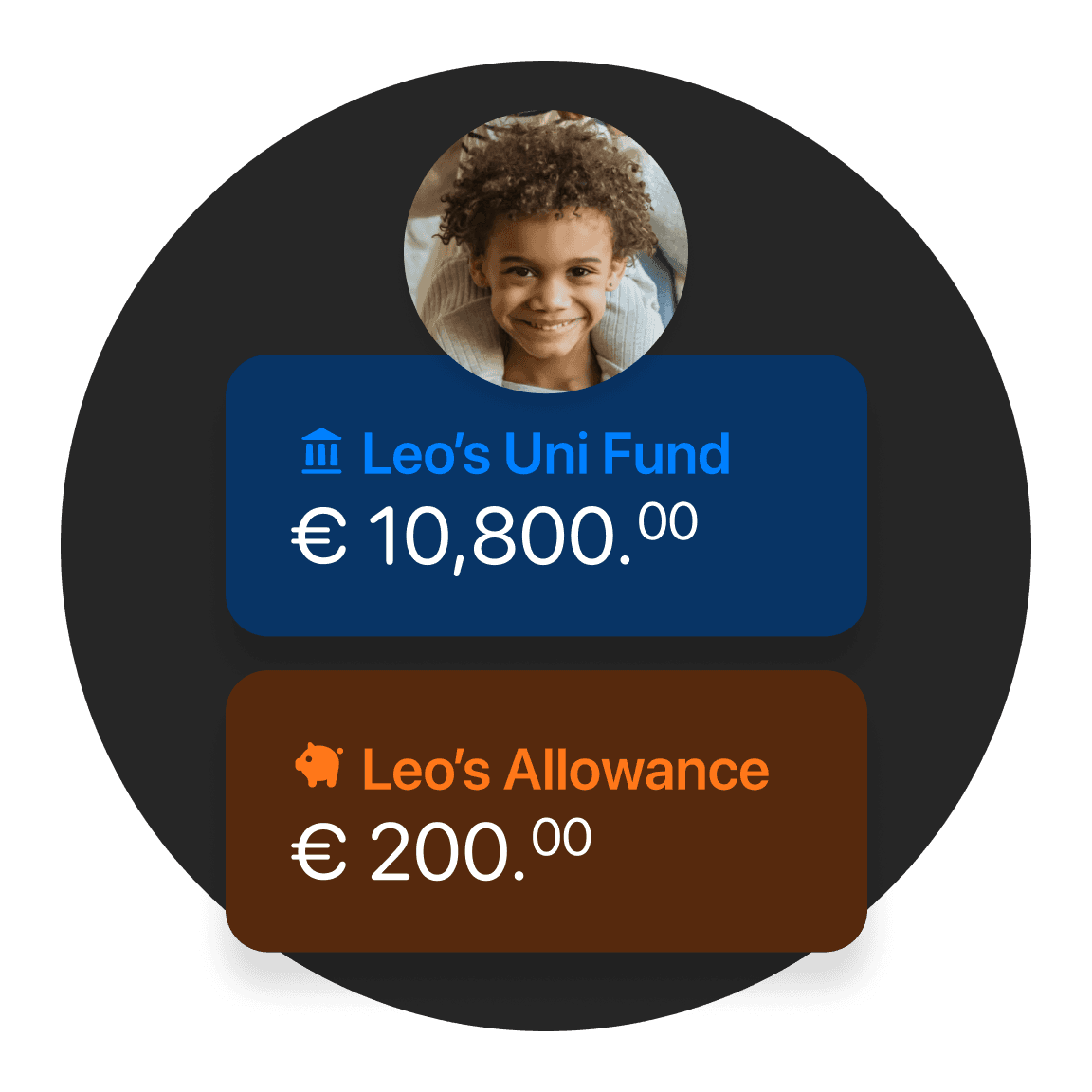

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

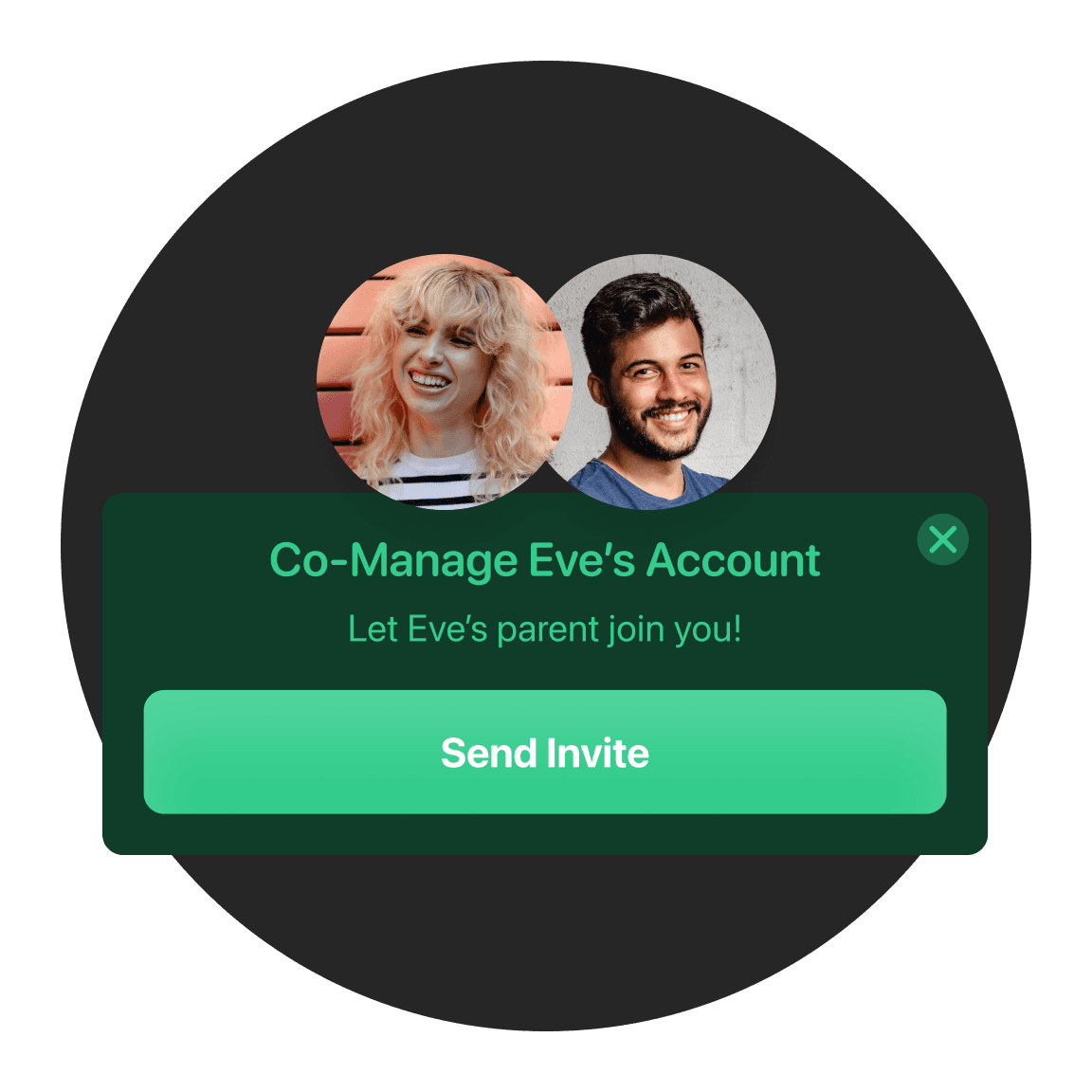

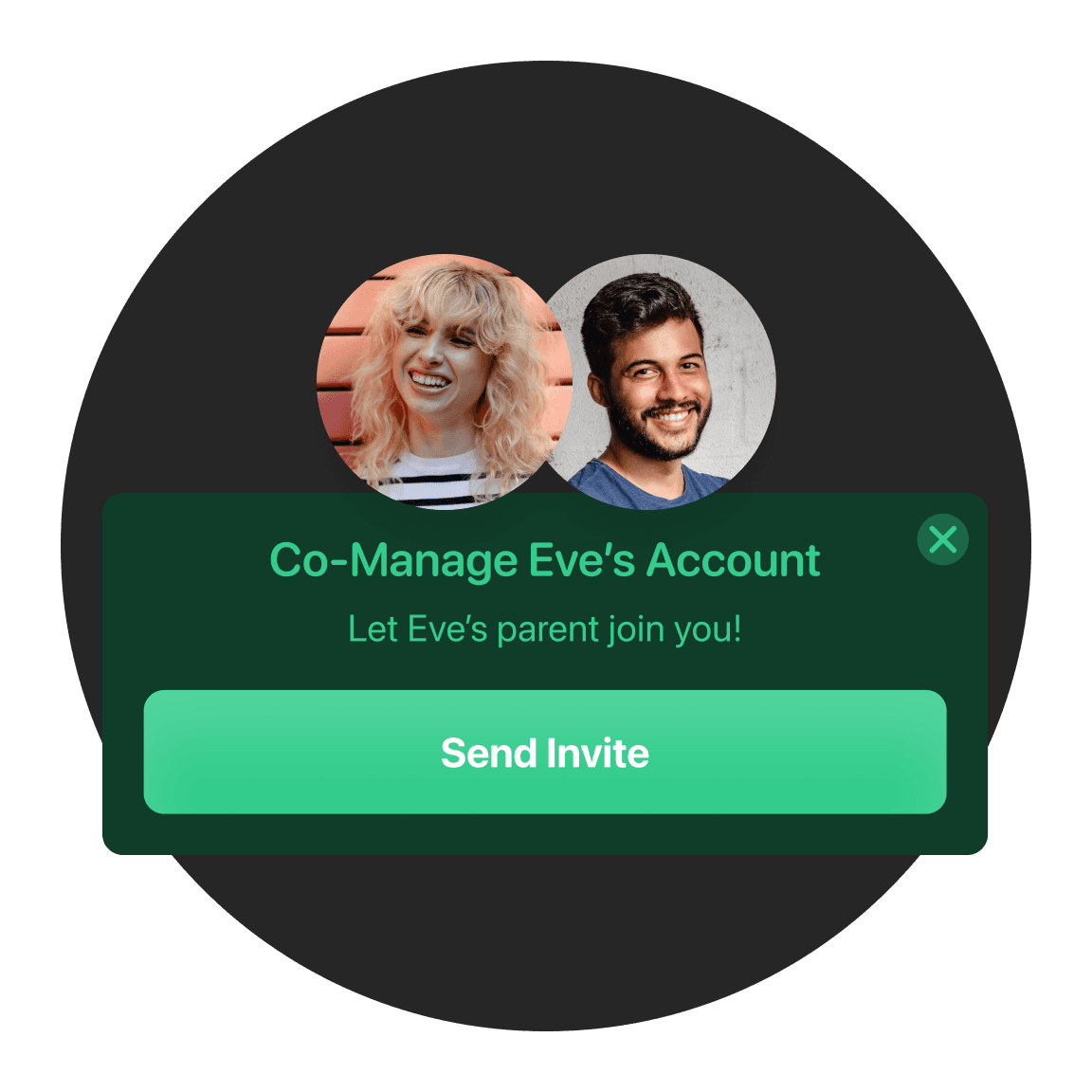

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Your child earns up to 2.67% interest on savings

Give your child a financial head start with a dedicated savings account that earns up to 2.67% interest. With weekly payouts, their savings grow faster—turning small contributions into big results over time.

Your child earns up to 2.67% interest on savings

Give your child a financial head start with a dedicated savings account that earns up to 2.67% interest. With weekly payouts, their savings grow faster—turning small contributions into big results over time.

Your child earns up to 2.67% interest on savings

Give your child a financial head start with a dedicated savings account that earns up to 2.67% interest. With weekly payouts, their savings grow faster—turning small contributions into big results over time.

Prepaid credit card

Your child gets their own bunq prepaid credit card, allowing them to spend responsibly with zero debt risk. You’ll be instantly notified whenever they make a payment.

Prepaid credit card

Your child gets their own bunq prepaid credit card, allowing them to spend responsibly with zero debt risk. You’ll be instantly notified whenever they make a payment.

Prepaid credit card

Your child gets their own bunq prepaid credit card, allowing them to spend responsibly with zero debt risk. You’ll be instantly notified whenever they make a payment.

Budgeting made easy

Create up to 25 money pots for your child to spend, save, and grow their money in a fun way. Plus, track their budget with detailed insights, monthly comparisons, and categorized breakdowns.

Budgeting made easy

Create up to 25 money pots for your child to spend, save, and grow their money in a fun way. Plus, track their budget with detailed insights, monthly comparisons, and categorized breakdowns.

Budgeting made easy

Create up to 25 money pots for your child to spend, save, and grow their money in a fun way. Plus, track their budget with detailed insights, monthly comparisons, and categorized breakdowns.

Round up payments and save the difference

With AutoSave, your child's payments are rounded up, and the difference is sent directly to their savings account. For example, if they spend €4.10, €0.90 goes straight to their savings—that simple.

Round up payments and save the difference

With AutoSave, your child's payments are rounded up, and the difference is sent directly to their savings account. For example, if they spend €4.10, €0.90 goes straight to their savings—that simple.

Round up payments and save the difference

With AutoSave, your child's payments are rounded up, and the difference is sent directly to their savings account. For example, if they spend €4.10, €0.90 goes straight to their savings—that simple.

Automatically sort their pocket money

With Salary Sorter, your child’s incoming allowance is instantly sorted into their savings account or spending pot.

Automatically sort their pocket money

With Salary Sorter, your child’s incoming allowance is instantly sorted into their savings account or spending pot.

Automatically sort their pocket money

With Salary Sorter, your child’s incoming allowance is instantly sorted into their savings account or spending pot.

Personal payment link

Your child can set up their personal payment link so that family and friends can easily send them money straight to their account.

Personal payment link

Your child can set up their personal payment link so that family and friends can easily send them money straight to their account.

Personal payment link

Your child can set up their personal payment link so that family and friends can easily send them money straight to their account.

Scheduled Payments

Need to send your child their allowance regularly? Set up a Scheduled Payment, and the bunq app will take care of it when the time comes.

Scheduled Payments

Need to send your child their allowance regularly? Set up a Scheduled Payment, and the bunq app will take care of it when the time comes.

Scheduled Payments

Need to send your child their allowance regularly? Set up a Scheduled Payment, and the bunq app will take care of it when the time comes.

Offset CO2

With their bunq card, your child can earn trees for every purchase. Through our partner veritree, these trees are planted in Kenya and Tanzania. Together, bunq users have already planted over 25 million mangrove trees!

Offset CO2

With their bunq card, your child can earn trees for every purchase. Through our partner veritree, these trees are planted in Kenya and Tanzania. Together, bunq users have already planted over 25 million mangrove trees!

Offset CO2

With their bunq card, your child can earn trees for every purchase. Through our partner veritree, these trees are planted in Kenya and Tanzania. Together, bunq users have already planted over 25 million mangrove trees!

Trusted by millions of users

Insured up to €100,000

Your child's money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your child's money is protected if something doesn't go as planned.

Instant Payments

Your child can send and receive money instantly, no waiting.

24/7 support

Help in your language, whenever your child needs it.

Trusted by millions of users

Insured up to €100,000

Your child's money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your child's money is protected if something doesn't go as planned.

Instant Payments

Your child can send and receive money instantly, no waiting.

24/7 support

Help in your language, whenever your child needs it.

Trusted by millions of users

Insured up to €100,000

Your child's money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your child's money is protected if something doesn't go as planned.

Instant Payments

Your child can send and receive money instantly, no waiting.

24/7 support

Help in your language, whenever your child needs it.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Your child gets bunq Pro for free

Children enjoy bunq Pro (valued at €9.99/month) for free until they turn 18 years old.

bunq Pro

€9.99/month

Free

The bank account for your child to manage their finances.

bunq Elite

€18.99

€9.00/month

The bank account that grows with your child.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Choose your own plan

You and your child can enjoy the benefits of a bunq account when you subscribe to a paid bunq plan.

bunq Core

€3.99/month

The bank account for your child’s first steps in daily spendings and savings

bunq Pro

€9.99/month

The bank account for your child to manage their finances.

bunq Elite

€18.99

€18.99/month

The bank account that grows with your child.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Choose your own plan

You and your child can enjoy the benefits of a bunq account when you subscribe to a paid bunq plan.

bunq Core

€3.99/month

The bank account for your child’s first steps in daily spendings and savings

bunq Pro

€9.99/month

The bank account for your child to manage their finances.

bunq Elite

€18.99/month

The bank account that grows with your child.

Open your child's free bank account in just 5 minutes

Open your child's free bank account in just 5 minutes

Open your child's free bank account in just 5 minutes